- #W9 form 2021 pdf how to

- #W9 form 2021 pdf pdf

- #W9 form 2021 pdf update

- #W9 form 2021 pdf professional

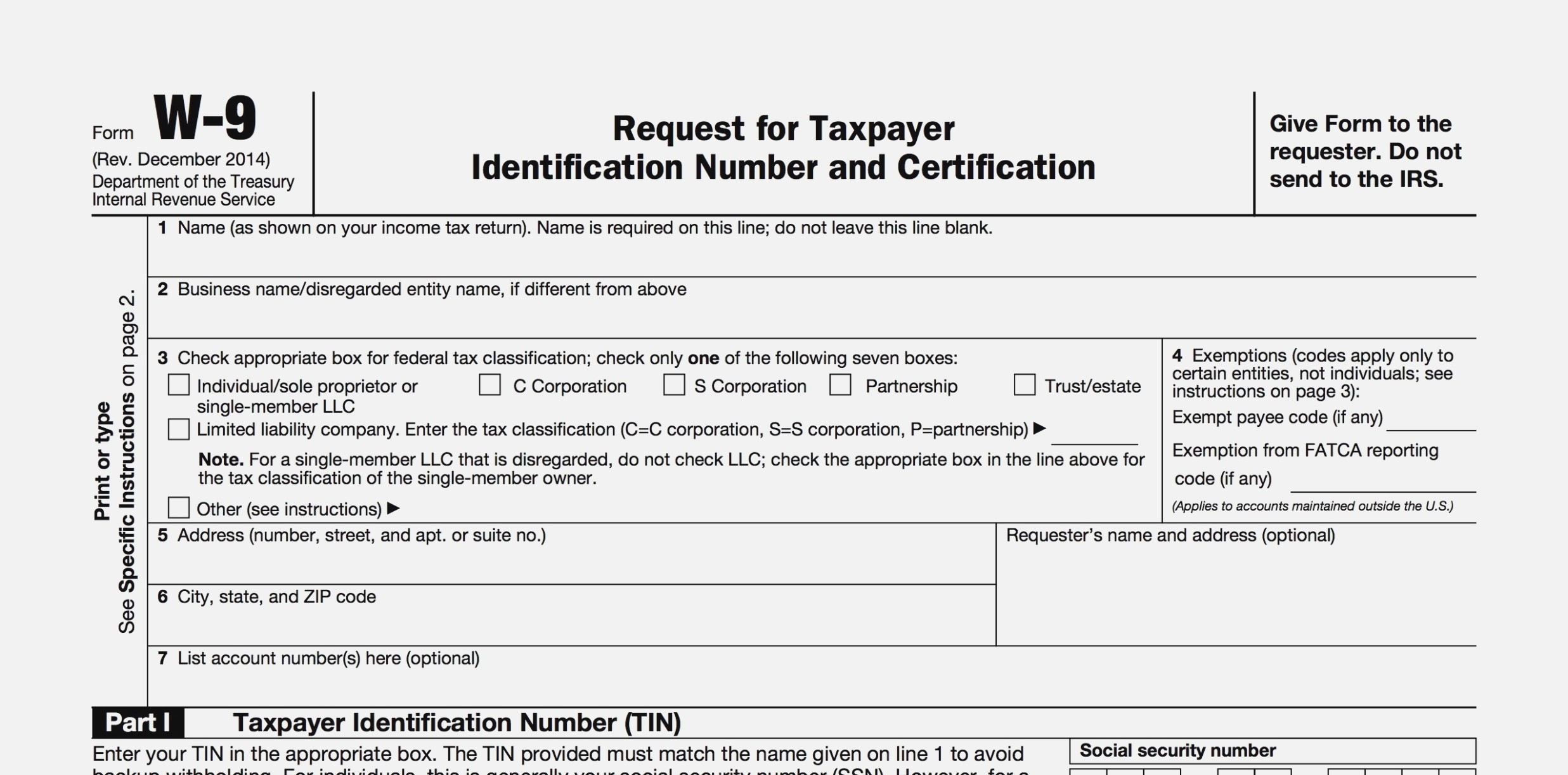

Working for a company as an independent contractor is one of the most frequent scenarios. When a person or business pays another person or business, the IRS frequently uses Form W-9 to collect the relevant data. Use your W-9s to report how much you paid each contractor at the end of the year to keep them safely kept. The IRS wants to know who you are paying so they can adequately pursue collection. The payment of Social Security and Medicare taxes by your business is not required, nor is the withholding of income taxes from payments made to independent contractors. You must obtain a W-9 if your company pays small businesses or independent contractors more than $600 per for work that has been completed.

This individual maintains the form on file and uses the data to generate other returns, including 10 Forms, as well as to determine whether federal tax withholding is required on the payments you receive.įor conducting business with independent contractors and freelancers, Form W-9 is necessary. The requester is not required to submit the W-9 to the IRS. Form W-9 is used to provide a correct TIN to payers (or brokers) required to file information returns with IRS.

#W9 form 2021 pdf how to

The W-9 Form must be obtained from you by the person or company who is paying you. Information about Form W-9, Request for Taxpayer Identification Number (TIN) and Certification, including recent updates, related forms, and instructions on how to file.

#W9 form 2021 pdf update

2022 W-9 Form Printable IRS Update Who Requests a W-9 Form? You collected accurate personal details if you verified them and updated this form with the most recent data. Employers must use the W-9 Form to collect information about contractors for income tax purposes. The information is used to create a 1099-NEC. Information including the IC's name, residence, social security number (SSN), and more are requested on the form. For tax reasons in the United States, a company needs to get important data about an independent contractor (IC) or freelancer through the W-9 Form or Request for Taxpayer Identification Number and Certification form. Form 1099-K (merchant card and third party network transactions) Form 1098 (home mortgage interest), 1098-E (student loan interest), 1098-T (tuition) Form 1099-C (canceled debt) Form 1099-A (acquisition or abandonment of secured property) Use Form W-9 only if you are a U.S. Mail.W9 Form 2022 - If you are a Freelance, Independent Contractor you may need to file a W9 Form often. " Foreign Account Tax Compliance Act (FATCA)." " Publication 3402: Taxation of Limited Liability Companies."

#W9 form 2021 pdf professional

" About Form W-8 BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)." The number shown on this form is my correct taxpayer identification number (or I am. Create this form in 5 minutes Use professional pre-built templates to fill in and sign documents online faster. " 2022 General Instructions for Certain Information Returns," Pages 25–27. " Am I Required to File a Form 1099 or Other Information Return?" " About Form W-4, Employee's Withholding Certificate." " Form W-9: Request for Taxpayer Identification Number and Certification,". For most individuals, the TIN will be their Social Security Number (SSN). Definition IRS Form W9 is used by a taxpayer, usually a business, to obtain the Social Security number or Federal Employer Tax ID number from a person or. An employer or other entity that is required to file an informational document with the IRS, such as Form 1099, must obtain your correct TIN to report any earnings or losses that may affect your federal tax return or your taxable income.

State Substitute Form W-9 - Requesting Taxpayer ID & Info PDF. Use our detailed instructions to fill out and eSign your documents online.

#W9 form 2021 pdf pdf

If you do not furnish a W-9 as requested, your client must withhold taxes from your earnings at a tax rate of 24%.Ī W-9 form is a formal written request for information only and is used solely for the purpose of confirming a person’s taxpayer identification number (TIN). State Federal Income Tax Exemption - IRS Government Affirmation PDF State Sales Tax. Quick guide on how to complete form w 9 2021 printable pdf Forget about scanning and printing out forms.Independent contractors who work with companies they are not employed with must often provide that company a W-9.The information collected by an entity on a W-9 form cannot be disclosed for any other purpose, under strict privacy regulations.The information taken from a W-9 form is often used to generate a 1099 tax form, which is required for income tax filing purposes.The W-9 is an official form furnished by the IRS for employers or other entities to verify the name, address, and tax identification number of an individual receiving income.

0 kommentar(er)

0 kommentar(er)